In today’s rapidly evolving energy landscape, selecting the right gas turbine manufacturer can be a game-changer for businesses looking to optimize efficiency and sustainability. With advancements in technology and growing emphasis on green energy, understanding the strengths and capabilities of leading manufacturers has never been more crucial. This article delves into a comparative analysis of top gas turbine manufacturers, including GE Vernova, Siemens Energy, and Mitsubishi Power. We will explore their market positions, key products, and technical specifications, providing a clear picture of how they stack up against each other. Ready to uncover which manufacturer stands out in efficiency, sustainability, and innovation? Let’s dive in and find out.

Overview of Top Gas Turbine Manufacturers

Gas turbines are pivotal in converting fuel into energy, making the selection of a reliable manufacturer crucial for project success. These turbines are essential in power generation and industrial applications, influencing the efficiency and sustainability of energy projects worldwide.

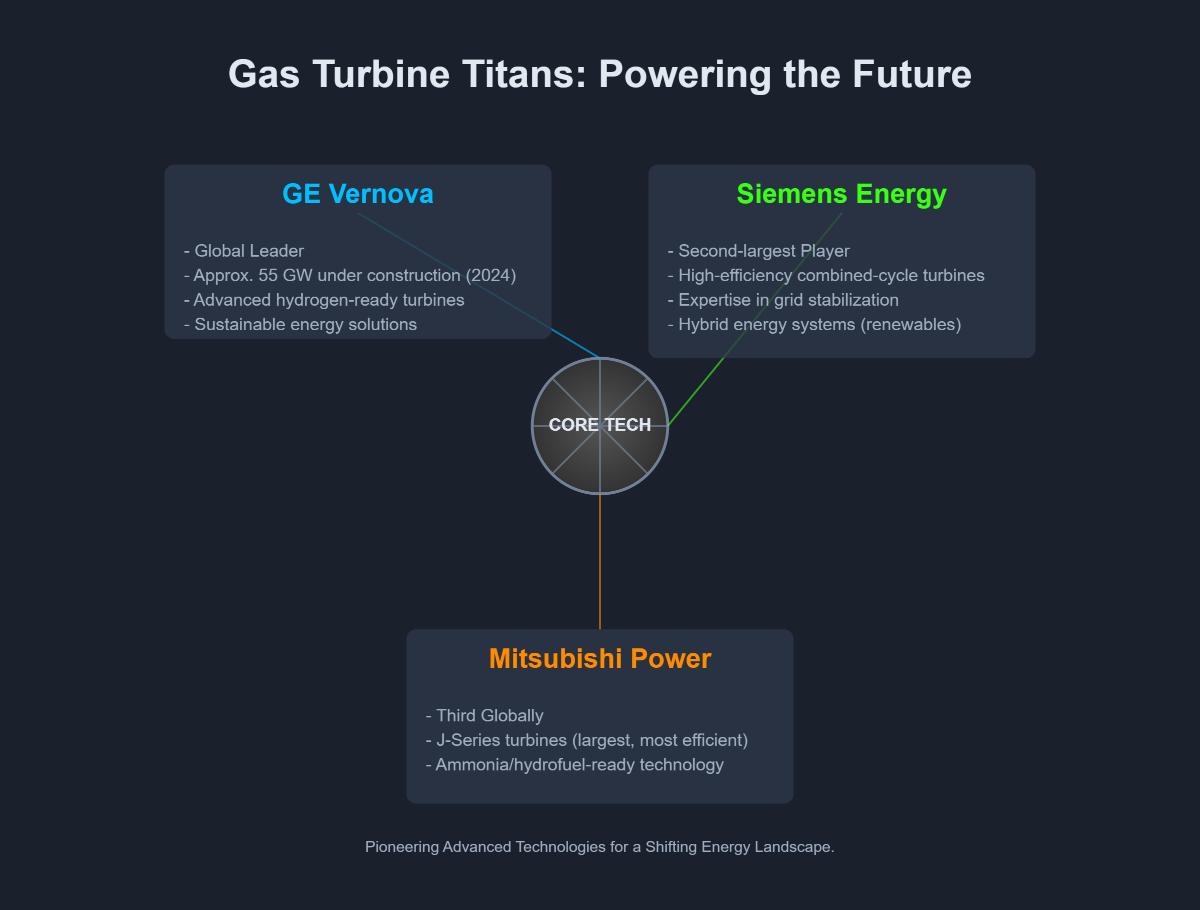

Leading Companies

GE Vernova

GE Vernova leads the industry with nearly 55 GW of turbines in development, offering cutting-edge technology for diverse applications. Their advanced turbines cater to both large-scale power plants and industrial settings, ensuring high efficiency and reliability.

Siemens Energy

Siemens Energy is a prominent player in the global gas turbine market. Known for its strategic partnerships and collaborations, Siemens enhances its presence in key regions, supporting the transition towards cleaner energy solutions. Their turbines are celebrated for their dependability and efficiency.

Mitsubishi Power

Mitsubishi Power distinguishes itself with its innovative approach to gas turbine technology. The company focuses on hydrogen-ready turbines, aligning with the industry’s shift towards sustainable energy. Mitsubishi Power’s substantial market share underscores its role as a leading manufacturer.

Regional Leaders: Rolls-Royce and Ansaldo Energia

Rolls-Royce and Ansaldo Energia are key players, with strong footholds in North America and Europe, respectively. They are renowned for their advanced technologies tailored to regional needs, providing solutions that meet specific local demands and regulations.

Kawasaki Heavy Industries

Kawasaki Heavy Industries is recognized for its diverse range of turbines, contributing significantly to the global market. The company’s emphasis on efficient solutions for power generation and industrial applications solidifies its competitive stance.

Bharat Heavy Electricals Limited (BHEL)

BHEL plays a crucial role, particularly in the Indian market, offering a broad spectrum of gas turbines with advanced technologies to meet various power generation needs.

Capstone Green Energy

Capstone Green Energy stands out with its focus on microturbines, providing clean, efficient solutions that help reduce emissions. Their innovative approach emphasizes sustainability and efficiency in power generation.

MAN Energy Solutions

MAN Energy Solutions is a notable contributor to the global market, offering advanced technologies for both power generation and industrial applications. Their commitment to sustainable energy solutions is aligned with global trends towards cleaner power.

Innovation and Sustainability

Manufacturers are prioritizing hydrogen-ready turbines, a crucial step in transitioning to cleaner energy and minimizing carbon emissions in power generation. This focus on technological advancement is essential for reducing environmental impact and supporting global energy transitions.

GE Vernova

Company Background

GE Vernova, a division of General Electric, is a leader in the gas turbine manufacturing industry, known for its innovation and engineering excellence. With a history rooted in pioneering technology, GE Vernova has played a crucial role in advancing turbine solutions to meet the evolving demands of the energy sector. The company’s dedication to sustainability and efficiency has solidified its position as a market leader.

Key Products and Technologies

GE Vernova’s portfolio includes both aeroderivative and heavy-duty gas turbines, designed to cater to various energy needs. Their aeroderivative turbines are derived from aviation engines, offering high efficiency and flexibility, making them suitable for applications requiring quick start-up times. Heavy-duty turbines, known for their robustness and high output, are ideal for large-scale power plants, capable of delivering outputs ranging from 34 MW to 571 MW.

Market Position and Strengths

GE Vernova dominates the market with nearly 55 gigawatts of turbines under construction. Their key strengths include technological leadership, a global presence, and innovative partnerships. The company invests heavily in research and development to enhance turbine performance, efficiency, and sustainability. With a significant footprint in major markets across the world, supported by a robust network of service centers and partnerships, GE Vernova remains at the forefront of the industry. Strategic collaborations, such as the joint venture with GE Saudi Advanced Turbines (GESAT), enable GE Vernova to expand its technological capabilities and market reach. GESAT’s recent achievement of manufacturing the first H-class gas turbine in Saudi Arabia exemplifies this strength.

In-Depth Technical Specifications

The LM6000 aeroderivative turbine offers up to 44 MW with 42% efficiency, ideal for power generation and mechanical drive applications. The LM2500 delivers up to 34 MW with a thermal efficiency of 38%, known for its reliability and operational flexibility. Among heavy-duty models, the 7HA.03 provides an output of up to 430 MW in simple cycle and 571 MW in combined cycle, with an efficiency of over 64% in combined cycle operation. The 9HA.02 delivers up to 571 MW in combined cycle, achieving efficiencies greater than 64%, designed for large-scale power plants.

Innovation and Sustainability

GE Vernova is committed to developing sustainable energy solutions. They are integrating hydrogen into their turbines to support the transition to cleaner energy, aiming to reduce carbon emissions and enhance sustainability. By making their turbines hydrogen-ready, GE Vernova contributes to the global shift towards more environmentally friendly power generation.

Siemens Energy

Company Background

Siemens Energy is a leading global energy technology company known for its significant contributions to the power generation industry. With a rich history dating back to the mid-19th century, Siemens Energy has evolved to become a powerhouse in providing innovative and sustainable energy solutions. The company operates in over 90 countries, leveraging its extensive experience and expertise to deliver cutting-edge gas turbine technology.

Key Products and Technologies

Siemens Energy’s product portfolio includes a wide range of gas turbines designed to meet diverse energy needs. Their offerings encompass both industrial and heavy-duty turbines, each engineered for maximum efficiency and reliability.

- SGT-800: This industrial gas turbine provides a power output of up to 57 MW with an impressive efficiency of 40% in simple cycle and over 60% in combined cycle operations, making it well-suited for both power generation and mechanical drive applications.

- SGT-400: A versatile turbine delivering up to 15 MW, known for its robust design and operational flexibility. It offers efficiency levels of approximately 35% in simple cycle.

- SGT5-8000H: One of Siemens Energy’s flagship heavy-duty turbines, it delivers up to 450 MW in simple cycle and exceeds 64% efficiency in combined cycle operation, making it ideal for large-scale power plants.

Market Position and Strengths

Siemens Energy holds a prominent position in the global gas turbine market, often ranking among the top three manufacturers alongside GE Vernova and Mitsubishi Power. The company accounted for 26% of global gas turbine orders by megawatts (MW) in 2022, reflecting its strong market presence and competitive edge.

Technology Leadership

Siemens Energy’s gas turbines are recognized for their advanced technology and high efficiency. The company employs state-of-the-art materials and 3D printing techniques to enhance turbine performance and reliability. Their turbines achieve efficiency levels exceeding 64%, positioning Siemens Energy as a leader in technological innovation.

Hydrogen Readiness

Siemens Energy is developing turbines that can operate on hydrogen, with the goal of achieving 100% hydrogen operation by 2030. Projects like HYFLEXPOWER in France demonstrate Siemens Energy’s commitment to hydrogen readiness, showcasing the feasibility of hydrogen-powered gas turbines.

Global Footprint

Siemens Energy’s turbines are tested and proven in diverse and extreme conditions worldwide, ensuring their reliability and capability to meet various environmental and application demands. This extensive global footprint ensures that Siemens Energy turbines are reliable and capable of meeting the demands of various environments and applications.

In-Depth Technical Specifications

Siemens Energy’s gas turbines are designed to offer superior performance and efficiency. Detailed specifications of their key models are as follows:

- SGT-800:

- Power output: Up to 57 MW

- Efficiency: 40% (simple cycle), over 60% (combined cycle)

- SGT-400:

- Power output: Up to 15 MW

- Efficiency: Approximately 35% (simple cycle)

- SGT5-8000H:

- Power output: Up to 450 MW (simple cycle)

- Efficiency: Over 64% (combined cycle)

These specifications highlight Siemens Energy’s commitment to delivering high-performance turbines that cater to a wide range of power generation needs.

Strategic Shifts and Future Risks

Siemens Energy is actively positioning itself as a key player in the energy transition through strategic partnerships and innovations. The company has formed joint ventures to enhance its technological capabilities and market reach. Siemens Energy’s focus on hydrogen-compatible turbines and fleet upgrades aims to address challenges like declining gas demand and increased competition from renewable energy sources.

Mitsubishi Power

Company Background

Mitsubishi Power, a subsidiary of Mitsubishi Heavy Industries, has emerged as a leader in the global gas turbine industry, leveraging its engineering expertise to drive innovation in advanced turbine technologies. With a rich heritage in engineering excellence and innovation, the company has played a pivotal role in developing advanced turbine technologies that meet the evolving demands of energy markets worldwide. Mitsubishi Power’s commitment to sustainability and high-efficiency solutions is evident in its strategic focus on hydrogen-ready turbines and large-scale power generation projects.

Key Products and Technologies

Mitsubishi Power is renowned for its high-capacity heavy-duty gas turbines (HDGTs), particularly the J-Series Air-Cooled (JAC) turbines. These turbines are engineered for exceptional efficiency and performance, achieving outputs exceeding 100 MW, and are notable for their ability to integrate hydrogen co-firing technology—aligning with global trends toward decarbonization.

Market Position and Strengths

In recent years, Mitsubishi Power has consistently secured a dominant position in the gas turbine market, holding a significant share of the global market. In 2023, the company held 36% of the global market share, underscoring its leadership in large-scale turbine solutions. Mitsubishi Power’s strength lies in its ability to deliver high-efficiency turbines that support the transition to cleaner energy, making it a preferred choice for power generation projects across Europe, the Americas, and Asia.

Strategic Advantages

Mitsubishi Power’s JAC turbines provide a competitive edge through their high efficiency and readiness for hydrogen integration. This positions the company as a key player in the global shift towards decarbonized power generation. By leveraging its advanced technology and extensive market experience, Mitsubishi Power continues to secure strategic project wins, bolstering its market presence and influence.

In-Depth Technical Specifications

The JAC series turbines are designed for high efficiency, making them suitable for both simple and combined cycle applications, and their capability to operate with hydrogen enhances their appeal for sustainable energy projects.

Challenges and Future Outlook

While Mitsubishi Power leads in terms of total megawatts sold, it faces increasing competition from other market players such as GE Vernova, particularly in regions like Asia where project activity is intense. The company’s future success depends on expanding its hydrogen-compatible offerings and seizing emerging market opportunities, particularly in Southeast Asia and Africa.

Comparative Analysis of Gas Turbine Products

Criteria for Comparison

When comparing gas turbine products from top manufacturers, several key criteria must be considered to evaluate their performance and suitability for different applications. Key criteria to consider are:

- Efficiency: The ability of a turbine to convert fuel into energy effectively, impacting overall operational costs and environmental footprint.

- Sustainability: Incorporation of technologies that allow for reduced emissions, such as hydrogen readiness, which is becoming increasingly important in today’s energy landscape.

- Cost: Both initial investment and long-term operational costs, which can vary significantly between manufacturers.

- Reliability: The consistency and dependability of turbine operation, crucial for minimizing downtime and maintenance costs.

- Technological Innovation: The extent to which manufacturers incorporate cutting-edge technologies, such as advanced materials and design improvements, to enhance turbine performance.

Side-by-Side Comparison of Leading Manufacturers

General Electric (GE Vernova)

- Efficiency: Known for high efficiency in its advanced-frame turbines, particularly the HA series.

- Sustainability: Focused on hydrogen-ready turbines, offering flexibility in energy transitions.

- Cost: Competitive pricing with robust service support.

- Reliability: High reliability with a proven track record in diverse applications.

- Technological Innovation: Strong emphasis on research and development, continuously advancing their technology.

Siemens Energy

- Efficiency: Provides turbines with over 64% efficiency in combined cycle mode.

- Sustainability: Active in developing hydrogen-compatible turbines, aiming for 100% hydrogen operation by 2030.

- Cost: Provides cost-effective solutions through strategic partnerships, enhancing value.

- Reliability: Global footprint ensures turbines are tested in various conditions, ensuring reliability.

Mitsubishi Power

- Efficiency: High-capacity turbines with outputs exceeding 100 MW, optimized for efficiency.

- Sustainability: The J-Series Air-Cooled turbines are designed for hydrogen compatibility, aiding in reducing carbon emissions.

- Cost: Competitive pricing, particularly for large-scale projects.

- Reliability: Strong presence in the market, known for reliable heavy-duty turbines.

- Technological Innovation: Focuses on integrating hydrogen co-firing technology in turbines.

Strengths and Weaknesses

GE Vernova

- Strengths: High efficiency and reliability, strong market position, innovative hydrogen-ready designs.

- Weaknesses: May face challenges in adapting to emerging technologies at the same pace as competitors.

Siemens Energy

- Strengths: Advanced efficiency and sustainability initiatives, strategic partnerships.

- Weaknesses: Complexity in managing global operations can impact responsiveness.

Mitsubishi Power

- Strengths: Dominant market position with hydrogen integration capabilities, strong efficiency metrics.

- Weaknesses: Faces intense competition in key regions, requiring continuous innovation.

Unique Applications of Gas Turbines

Applications in Aviation

Gas turbines are integral to aviation, powering a wide range of aircraft from commercial jets to military fighters. Advancements in aero-derivative designs have significantly improved efficiency and reliability, making them a top choice for future aviation. These turbines are designed to provide the thrust necessary for aircraft propulsion, with advancements in materials and engineering improving fuel efficiency and reducing maintenance costs.

Power Generation

Gas turbines play a critical role in power generation, particularly in combined cycle plants where they are paired with steam turbines to maximize efficiency, achieving efficiencies exceeding 64% in models like GE Vernova’s 9HA series. These turbines are essential for meeting the growing demand for electricity, providing a reliable and scalable solution for both large and small-scale power plants.

Marine and Offshore Applications

In marine and offshore environments, gas turbines are used for both propulsion and power generation. Their efficiency and durability in demanding conditions make them perfect for ships and offshore platforms. Siemens Energy, for example, emphasizes reliability and reduced carbon footprint in its turbines used in these sectors, ensuring that they can withstand harsh environmental conditions while maintaining operational efficiency.

Industrial and Oil & Gas Sector

Gas turbines are crucial in the industrial and oil & gas sectors, where they drive pumps and compressors necessary for extraction and processing. Their robustness and efficiency ensure smooth operations in tough environments. They offer the necessary power to sustain continuous operations, thereby enhancing productivity and operational reliability in these industries.

Emerging and Innovative Uses

The adaptability of gas turbines extends to emerging applications such as decentralized power generation and integration with renewable energy sources. They offer backup power and improve energy resilience, especially in areas with unreliable grids. Manufacturers are exploring innovative uses, such as integrating gas turbines with solar or wind power systems, to create hybrid solutions that offer both reliability and sustainability.

Gas turbines continue to evolve, with manufacturers focusing on innovations that enhance efficiency and reduce environmental impact. Their versatility across various industries underscores their importance in both traditional and emerging energy sectors.

Market Trends and Forecasts

Market Dominance of Key Players

The gas turbine market is predominantly controlled by three major players: GE Vernova, Siemens Energy, and Mitsubishi Power. These companies collectively hold approximately two-thirds of the market share for gas-fired power plants under construction. GE Vernova is the market leader, with 55 gigawatts of turbines currently being built worldwide. Siemens Energy and Mitsubishi Power follow, with significant shares in various regions.

Regional Market Dynamics and Global Partnerships

In Asia, GE Vernova dominates the market, accounting for 38% of the region’s gas turbine projects under construction, driven by the demand for flexible power solutions. Mitsubishi Power holds 17% of the market share, while Siemens Energy expands its influence through joint ventures. Manufacturers are increasingly leveraging these collaborations to position themselves as key players in the energy transition. Siemens Energy has notable partnerships in Europe and Asia, focusing on hydrogen-ready turbines and grid stability, which are essential for expanding technological capabilities and market reach.

Technological and Operational Trends

Most new installations feature gas turbines between 250 and 500 MW. Siemens Energy’s SGT5/6-8000H models have maintained steady orders, averaging 2–5 units per year since 2018. This output range is critical for meeting the growing demand for efficient and reliable power generation solutions. A significant trend in the market is the retrofitting of existing turbines to accommodate hydrogen blends, which reduces the need for new installations and extends the lifecycle of current assets. Manufacturers are focusing on hydrogen compatibility to align with global sustainability goals.

Market Stability

Experts anticipate steady market growth for gas turbines in power generation. This stability is tied to the gradual phase-out of coal and nuclear power plants and the integration of renewable energy sources. Despite challenges such as volatile natural gas prices and competition from renewables, the market is expected to grow steadily.

Market Forecasts

The global gas turbine market, valued at $17.24 billion in 2017, is projected to reach $22.01 billion by 2025, with a compound annual growth rate (CAGR) of 4.02%. Clean energy mandates and distributed power demand are key drivers of this growth. The market faces challenges such as volatile natural gas prices and increasing competition from renewable energy sources like solar and wind. However, retrofitting existing turbines and adopting hydrogen blends are strategies that mitigate these risks.

Comparative Table: Top Manufacturers (2024–2025)

Here’s a quick look at the top manufacturers and their strategies for 2024–2025:

| Manufacturer | Market Share | Key Focus | Recent Projects |

|---|---|---|---|

| GE Vernova | ~38–55 GW | Hydrogen-ready turbines, Asia | Leading in Asia’s under-construction projects |

| Siemens Energy | ~20–29% | Joint ventures, SGT5/6-8000H | 105 SGT5/6-8000H units installed globally |

| Mitsubishi Power | ~11–17% | High-efficiency models, Asia | 17% share in Asia’s turbine projects |

Leading manufacturers are prioritizing hydrogen compatibility and regional partnerships to address energy transition demands. Despite pressures from renewable energy sources, gas turbines remain crucial for grid flexibility and backup power, ensuring their sustained relevance in the market.

Sustainability Initiatives

Sustainability Initiatives of Leading Gas Turbine Manufacturers

Gas turbine manufacturers are increasingly focusing on sustainability to meet the growing demand for cleaner energy solutions. The leading companies—GE Vernova, Siemens Energy, and Mitsubishi Power—are pioneering various initiatives to enhance the environmental performance of their products. These efforts are aimed at reducing carbon emissions, integrating renewable energy sources, and promoting overall energy efficiency.

GE Vernova

Hydrogen Integration and Global Expansion

GE Vernova is committed to developing hydrogen-ready gas turbines that can operate efficiently on a blend of natural gas and hydrogen. This initiative, along with their expansion in Asia, supports cleaner energy growth and local sustainability efforts.

Technological Advancements

GE Vernova invests in research and development to innovate turbine technology, balancing market demand with the transition to lower-carbon power solutions.

Siemens Energy

Hydrogen Readiness

Siemens Energy emphasizes hydrogen readiness in its gas turbine portfolio. Their turbines are designed to switch between natural gas and hydrogen fuels, reducing carbon footprints and promoting flexible power generation. Siemens Energy is actively developing turbines capable of operating on 100% hydrogen by 2030.

Strategic Partnerships

Siemens Energy collaborates with partners to enhance its sustainability initiatives, aiming to decarbonize power generation globally through advanced technologies.

High-Efficiency Turbines

Siemens Energy’s turbines are part of the advanced frame and industrial gas turbine market segments. They deliver high efficiency and lower emissions, supporting grid stability alongside renewable energy sources.

Mitsubishi Power

Hydrogen-Capable Turbines and Strategic Market Focus

Mitsubishi Power invests in hydrogen-capable turbines designed for flexible and efficient power generation. Their strong focus on the Asian market aligns with regional energy transition efforts.

Technological Innovation

Mitsubishi Power’s turbines are engineered for high efficiency and sustainability. Their strategic partnerships and joint ventures drive the adoption of clean technology, positioning the company as a leader in the global shift towards decarbonized power generation.

Comparative Summary

| Aspect | GE Vernova | Siemens Energy | Mitsubishi Power |

|---|---|---|---|

| Hydrogen Readiness | Strong focus; heavy investment | Strong focus; strategic partnerships | Focus on hydrogen-capable turbines |

| Flexibility & Efficiency | High; supports renewables | High; advanced frame turbines | High; turbine series designed for flexibility |

| Regional Expansion Focus | Asia-centric | Global with strong Asian presence | Strong Asian market focus |

Key Industry Trends

- The gas turbine market is witnessing strong order growth, driven by the demand for efficient and flexible power generation solutions.

- Advanced-frame turbines (>225 MW) dominate the market, reflecting the need for technologies that support energy transition goals.

- All three manufacturers are focusing on hydrogen-ready technology as a crucial pathway to decarbonize natural gas power plants and maintain relevance in the evolving energy landscape.

These sustainability initiatives demonstrate the commitment of GE Vernova, Siemens Energy, and Mitsubishi Power to advancing cleaner energy solutions. Their efforts are instrumental in supporting the global energy transition, balancing the current demands with the need for sustainable and flexible power generation options.

Frequently Asked Questions

Below are answers to some frequently asked questions:

Who are the top gas turbine manufacturers?

The top gas turbine manufacturers are GE Vernova, Siemens Energy, and Mitsubishi Power. GE Vernova is a global leader with approximately 55 GW of turbines under construction as of 2024, focusing on advanced hydrogen-ready turbines and sustainable energy solutions. Siemens Energy is the second-largest player with high-efficiency turbines for combined-cycle plants and expertise in grid stabilization, expanding into hybrid energy systems integrating renewables. Mitsubishi Power ranks third globally, known for its J-Series turbines, which are among the largest and most efficient, and its ammonia/hydrofuel-ready technology. These manufacturers dominate the market due to their innovative technologies and strategic positioning in the energy transition.

What are the recent trends in the gas turbine market?

Recent trends in the gas turbine market reflect significant shifts driven by decarbonization, hybrid energy systems, and digitalization. The market is projected to grow at a CAGR of 4.2–5.4% through 2034, with total revenue expected to reach USD 20.1 billion by 2025. Key trends include the adoption of decentralized power and hybrid systems, which integrate renewables like solar and wind with gas turbines to ensure grid stability. Fuel flexibility and emission reductions are also critical, with manufacturers retrofitting turbines for low-carbon fuels such as biofuels and hydrogen blends. Digitalization and AI advancements, exemplified by GE Vernova’s collaboration with Oak Ridge National Laboratory, enhance operational efficiency and predictive maintenance. Additionally, there has been a notable 32% increase in global gas turbine orders in 2024, driven by the need for reliable power amid the phase-out of coal and challenges in renewable integration.

How do different gas turbine manufacturers compare?

Gas turbine manufacturers like GE Vernova, Siemens Energy, and Mitsubishi Power are leading the industry with distinct strengths. GE Vernova is notable for its significant market share, driven by its hydrogen-ready turbines that support the energy transition. Siemens Energy is recognized for its focus on efficiency and flexibility, catering to diverse power generation needs. Mitsubishi Power is investing in advanced technologies, including hydrogen-compatible turbines, to enhance its presence in gas-fired power plants.

Other manufacturers such as Rolls-Royce and Pratt & Whitney contribute through specialized offerings like aeroderivative turbines, emphasizing innovation and high efficiency. Despite the rising demand for gas turbines, manufacturers are cautious about scaling up production due to market uncertainties and high expansion costs. The industry’s shift towards sustainable energy solutions, particularly hydrogen-ready turbines, indicates a commitment to future energy demands and environmental considerations.

What are the unique applications of gas turbines in power generation and industrial applications?

Gas turbines have unique applications in both power generation and industrial settings due to their high efficiency, versatility, and compact design.

In power generation, gas turbines are integral to combined cycle systems and combined heat and power (CHP) configurations. Combined cycle systems enhance efficiency by using waste heat from the gas turbine to produce steam, which drives a steam turbine for additional electricity generation, achieving efficiencies of over 60%. CHP systems provide both electricity and heat, making them highly efficient for industrial and district heating applications, particularly in settings that require both power and heat.

In industrial applications, gas turbines are used for mechanical drive purposes, powering machinery such as pumps, compressors, and generators in sectors like oil and gas, petrochemical, and LNG operations. Their compact design and high power-to-weight ratio make them suitable for mobile and remote applications. Additionally, gas turbines are designed to be safe and quiet, making them ideal for urban environments and industrial settings where noise reduction is crucial.

Manufacturers like General Electric (GE) and Siemens Energy lead in providing advanced gas turbine solutions, continually innovating to enhance efficiency and expand their range of applications across various sectors.

How do gas turbine manufacturers address sustainability?

Gas turbine manufacturers address sustainability through several innovative strategies. GE Vernova, for example, integrates hydrogen fuel into its turbines, enhancing their ability to operate with hydrogen blends and supporting carbon capture initiatives like the Net Zero Teesside Power project. Mitsubishi Power focuses on hydrogen combustion and storage solutions, demonstrated at the Takasago Hydrogen Park, where they utilize on-site electrolysis for hydrogen production. Hanwha emphasizes retrofitting existing turbines with technologies such as FlameSheet™ combustion systems to efficiently use refinery off-gas, extending turbine life and reducing metal waste. Across the industry, manufacturers are also adopting circular economy practices by prioritizing upgrades and recycling components, thus minimizing environmental impact. These initiatives are complemented by advancements in carbon capture technologies and efficiency improvements, contributing to a more sustainable energy landscape. However, challenges such as high costs of hydrogen production and regulatory hurdles remain significant barriers to widespread implementation.